Merchant-based money laundering Part 1: Phantom Shipments

/Editor's Note: This article originally appeared on the Association of Certified Financial Crime Specialists on September 8, 2016.

This is an important story looking at the creativity of criminal networks in attempting to use credit cards, rather than cash deposits, wires or ACH transactions, in laundering their illicit proceeds and moving value across international borders while hopefully evading the transactional scrutiny of ever-more aggressive anti-money laundering (AML) teams.

This is a key development for financial crime compliance teams to be aware of because, though they may be very attuned to suspicious or aberrant activity tied possible money laundering, and in tandem, well-versed in the classic red flags of credit card fraud, AML analysts may not be looking at credit card transactions as a means to launder ill-gotten gains.

With that in mind, it would behoove banks with oversight responsibility of certain credit card relationships – and potentially related third-party payment processors and the merchant acquirers themselves, even those not subject to formal AML obligations – to start looking at credit card transactions and asking many of the same questions about if the activity could be a red flag for money laundering or the foundation of a suspicious activity report.

That would include things like:

- Do the credit card transactions make sense or a marked change, in terms of amounts, customers or items, from historical practices?

- Why is the merchant going international when they could get the same items domestically?

- Why is the merchant using credit cards for large transactions involving items they normally wouldn’t buy or sell, such as a fruit seller purchasing high-end electronics?

- Is there any hard evidence that, even though a payment was made, that an item was actually shipped?

“The reality is that merchant acquirers don’t have the same BSA/AML requirements of banks, but this doesn’t mean that if there is a valid money laundering typology that they shouldn’t collect their own intelligence,” Furst said.

This piece is a great read done for the best reason of all: to share information and insight with the broader financial crime and compliance community. Enjoy.

Transnational organized crime (TOC) groups have dealt with the perennial problem of moving value across borders undetected.

At some point all of these groups deal with the three steps in the money laundering process, but the first one, placement, is potentially the most hazardous hurdle to overcome. TOCs ship drugs to the United States via various means and have their major distribution hubs sell the drugs to other dealers.

The investigative journalist and author Patrick Radden Keefe gives an interesting account of the credit-based system in the drug trafficking trade in his New York Times article “Cocaine Incorporated,” which supports the assertion that cash generated in the United States must be laundered or smuggled back to Mexico.

“As preferred customers, they often took Chapo’s drugs without putting any money down, then paid the cartel only after they sold the product. This might seem unlikely, given the pervasive distrust in the underworld, but the narcotics trade is based on a robust and surprisingly reliable system of credit. In a sense, a cartel like Sinaloa has no choice but to offer a financing option, because few wholesale buyers have the liquidity to pay cash upfront for a ton of cocaine. “They have to offer lines of credit,” Wardrop told me, “no different from Walmart or Sears.” This credit system, known as “fronting,” rests on an ironclad assumption that in the American marketplace, even an idiot salesman should have no trouble selling drugs.”

But how do the cartels get the cash generated from drug deals which occurred on United States soil back into their possession?

There are several methods to achieve this, but the purpose of this article is to explore another possible way to move value across borders which can be coined as “merchant-based money laundering.”

The growth of credit cards for business-to-business (B2B) payments

Businesses in the United States are continuing to increase their use of corporate credit cards for business-to-business (B2B) payments. According to a payments study “spending increased 25 percent – from $196 billion to $245 billion – and is forecast to continue increasing at a rate of around 10 percent – through 2018.”

As well, many business credit cards offer attractive cash back reward programs so businesses are opting to pay their suppliers with a company credit card as opposed to an Automated Clearing House (ACH) transfer, check or wire.

Additionally, it is becoming more common for a business to use a company credit card to make a purchase of goods or services for tens of thousands of dollars in a single transaction.

What is a merchant?

A merchant can be defined as any business which accepts credit, debit, prepaid or gift cards as a form of payment with the assistance of a merchant acquirer. Click here to read more about merchant acquiring.

What is merchant-based money laundering?

Merchant-based money laundering can be defined as the process where goods and/or services are purchased by an individual or company from a merchant, but the goods or services are undervalued or not actually provided at all.

If the goods associated with the transaction were never actually shipped, then this could be categorized as a “phantom shipment.”

Merchant-based money laundering red flags

One example of merchant-based money laundering would be a cash-intensive business, such as a privately-owned supermarket located in the United States using a company credit card to make a high value purchase of goods from a Mexican merchant.

If the supermarket makes high-value purchases from the Mexican merchant on a regular basis, then it should be considered suspicious if one or more of the following criteria are met:

- The goods purchased are not likely to be resold in a supermarket, i.e. high end electronics, jewelry, etc.

- It’s possible to purchase similar products at comparable prices from another merchant located within the United States.

- The supermarket doesn’t usually use its company credit card to purchase other items it routinely sells, i.e. meat, produce, dairy, etc.

The below graphic shows some common cash-intensive business examples, but this list is not all inclusive. Click here to read more on cash-intensive businesses

What would merchant-based money laundering look like?

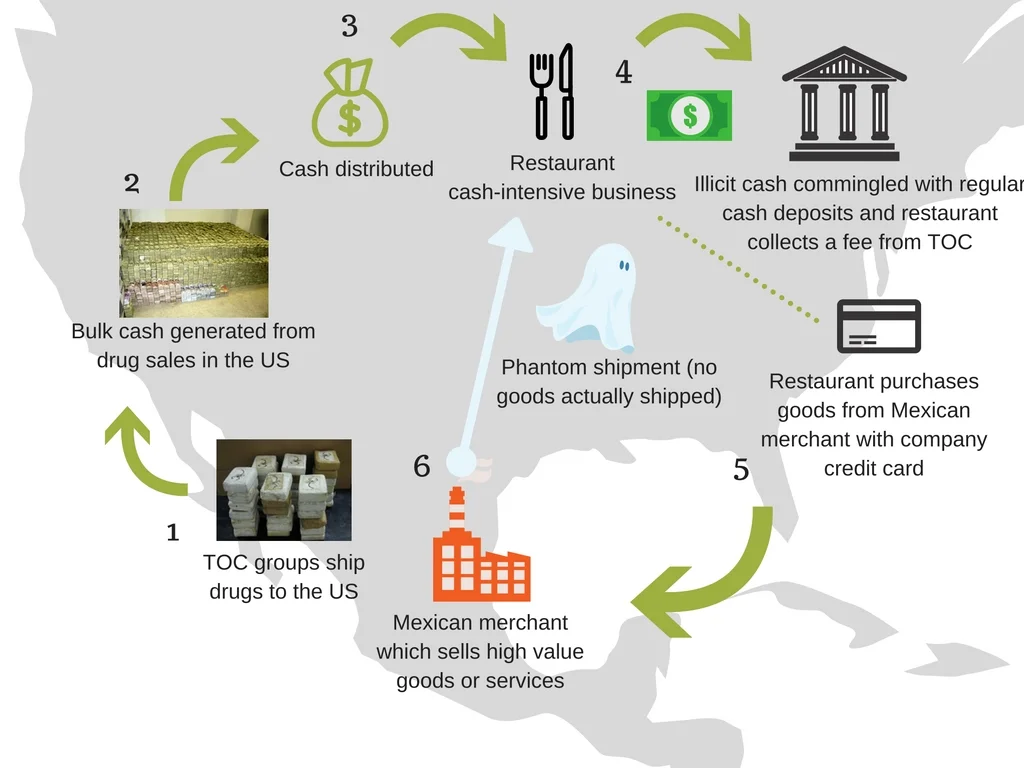

Merchant-based money laundering would typically follow this high-level flow:

- TOC groups ship drugs to the US: This step assumes that the TOC will ship drugs on credit and collect the cash at some point in the future. Additionally, the TOCs usually have their own people reselling the drugs to other dealers in the US.

- Bulk cash generated from drug sales: The TOC’s representatives sell the drugs to other dealers and now have a lot of cash which must be laundered or shipped in bulk back to Mexico.

- Cash distributed: The TOC’s representatives in the US use their local connections to form a network of alliances with cash-intensive businesses in the area where the group operates. The cash-intensive businesses are persuaded with a fee or are coerced into receiving regular deliveries of cash.

- Illicit cash commingled with regular cash deposits and restaurant collects a fee from TOC: The cash-intensive business takes the cash delivery from the TOC and deposits it with the company’s regular cash deposits over a period of time. The cash-intensive business is able to collect a fee for each cash delivery.

- Restaurant purchases goods from Mexican merchant with company credit card: The cash-intensive business is instructed by the TOC to make regular purchases from specific merchants located in Mexico on a regular basis.

- Phantom shipment (no goods actually shipped): The Mexican merchant receives the order from the cash-intensive business located in the United States. However, since the TOC has instructed both the cash-intensive business and the Mexican merchant of the process, no goods are actually shipped.

The above graphic simply illustrates that there are other innovative ways for TOCs to transfer value across borders.

The money laundering process doesn’t stop with the Mexican merchant, but the TOCs successfully passed the first step in the money laundering process by distributing cash to various businesses by converting cash deliveries into a bank deposit through the use of business credit cards.

I’m not a bank

The merchant acquirer processes the payments, but the merchant’s bank is the institution that deposits the money into the merchant’s account, so the acquirer could see itself more as a processing agent than a financial institution.

To a certain extent this is true, but the merchant acquirer will have access to data that the merchant’s bank won’t have and this data could contain money laundering typologies which should be monitored more closely. The merchant acquirer also tends to be more focused on chargebacks because this is the financial exposure of the acquirer and what could lead to a loss.

Why go to all of this trouble?

Some may be asking themselves why would the TOCs go to all of this trouble to launder their money through a merchant when they can simply have the U.S.-based cash-intensive business send a wire to Mexico?

This is a valid objection, but one way to think about the benefits of merchant-based money laundering to the TOCs, as opposed to simply sending international wires, is the level of risk associated with each type of transaction from a financial institution’s point of view.

Most financial institutions will categorize international wires as high-risk, but credit card and merchant acquiring activity will not fall into the same anti-money laundering (AML) risk category.

- If you were planning to drive a sports car over the speed limit, would you drive on a road where you knew the police were waiting with their radar guns or would you take a back road which was not as heavily policed?

So what now?

Merchant acquirers and credit card companies should be aware that TOCs and other criminal groups can use their financial products to move value across borders. While the cash is still being deposited into a bank account the merchant acquirer and credit card company will have access to data that the merchant’s bank doesn’t. If a business’ cash deposits increases how could the bank determine that the increase was generated from illicit sources as opposed to legitimate business revenue? The answer is that they can’t. The red flags may only be contained in the business’ credit card activity and with the merchant acquirer and only then will it become clear that the high value credit card purchases didn’t make business sense.