THE FUTURE OF ENTITY DUE DILIGENCE

/The world has gone through an incredible amount of technological transformation over the past ten years. While it may seem hard to imagine that change will continue at this pace, it’s not only likely to continue, but it will accelerate. There are various functional areas within institutions that support global commerce, but some have been laggards in adopting new technology for a plethora of reasons.

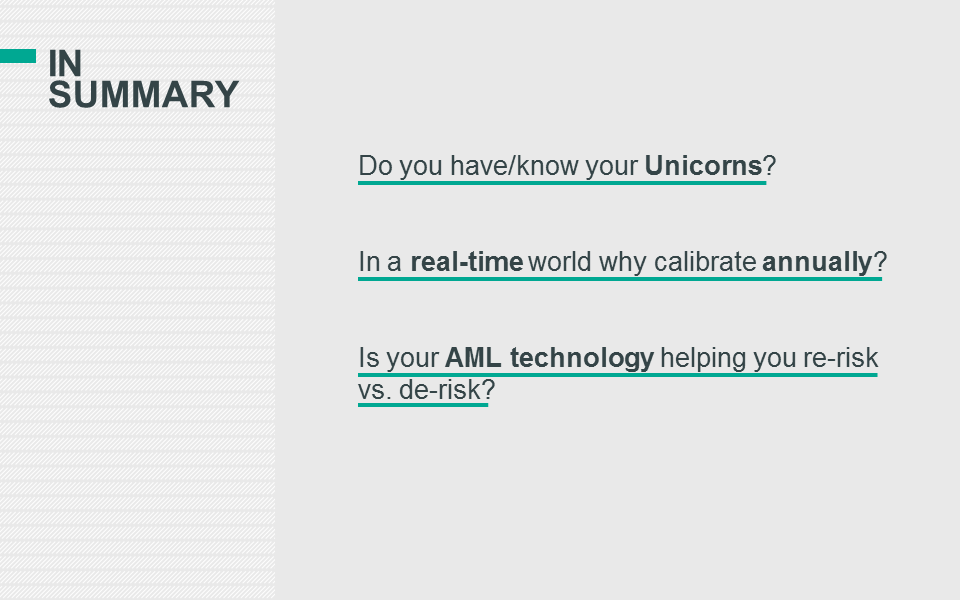

Structural market trends will force organizations to innovate or they will be subject to consolidation, reduction of market share, and, in some circumstances, complete liquidation. Future proofing the entity due diligence process is one key functional area that should be part of an organization's overall innovation road map because of the impacts of trends such as: rising regulatory expectations, disruptive deregulation initiatives, emergence of novel risks, explosion of data, quantifiable successes in artificial intelligence (AI), and changing consumer expectations.

Read More